Find your solar Investment Tax Credit for 2023 with the help of New England Solar Programs.

As we move into 2023, many homeowners and businesses in New England are considering making the switch to solar power. One of the main benefits of going solar is the ability to take advantage of the solar Investment Tax Credit (ITC). The ITC is a federal tax credit that allows homeowners and businesses to deduct a percentage of the cost of their solar panel system from their federal taxes. In this post, we’ll explore how to find your solar Investment Tax Credit for 2023 with the help of New England Solar Programs.

Understand the Solar Investment Tax Credit: The solar Investment Tax Credit is a federal tax credit that allows homeowners and businesses to deduct a percentage of the cost of their solar panel system from their federal taxes. The ITC is currently set at 30% for 2023, but it’s important to note that it will remain at 30% until 2032.

Discover Incentives and Rebates Available to Help Homeowners Save With Solar

We’ll Do the Digging, You Do the Saving!

We work with both local and nationwide certified solar installers and with our combined 15 years of solar experience, we’ll shop around and get competing quotes for you.

Your one stop shop for the most affordable way to get the best quality home solar with the best installers!

We use 3D Satellite Images to create a holograph of your neighborhood which allows us to do a full analysis online – and save you up to 40% more than other solar installers.

Simply take the free solar quiz to find out if your home qualifies, and you’ll receive a video overview of the best option available in your area.

What Others Are Saying…

“These guys made the whole process almost effortless! All of the crew that came to the house were professional, quick, and clean. The panels look great! I am happy that I have taken a step towards being a part of renewable energy, and also cutting my energy costs in half!” ~ Duston

“Mike has been a pleasure to deal with. He is knowledgeable, attentive, friendly and keeps to his promises. He has a high level of integrity and will always find the answer if he doesn’t know it when first asks. I can heartily endorse him.” ~ Bruce

“They answered all of our questions and responded to all of our emails and texts promptly. We are so impressed with our experience and are so happy that we made the right choice..” ~ Joe & Susan

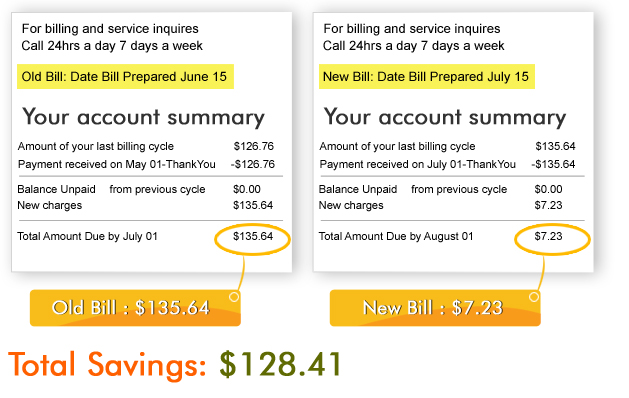

With no upfront costs for service or installation, you can start saving from day one. Solar panels are 70% cheaper today than they were 10 years ago, which means millions of homeowners that could not previously afford to do so are switching to solar. Solar panels can significantly reduce your cost of energy.

Rebates & Incentives

In order to get more people to switch to clean solar energy the federal and state governments are highly incentivizing homeowners who live in specific zip codes to go solar with $1000’s of dollars in rebates and incentives that can cover 100% of the costs associated with a new solar panel installation.

Why Go Solar?

Solar panels are an economical way for homeowners to lower their electric bill, increase their property value, and help the environment. Instead of paying electric companies top-tier costs for energy, solar panels allow you to lock in a low energy rate and save thousands year after year!

Copyright © 2023 Clean Energy Programs. All Rights Reserved

Calculate the Cost of Your Solar Panel System: To determine the amount of your ITC, you’ll need to calculate the cost of your solar panel system. This can include the cost of the solar panels, installation, and other associated costs. New England Solar Programs can help you estimate the cost of your solar panel system with their solar calculator.Calculate Your ITC: Once you’ve determined the cost of your solar panel system, you can calculate your ITC by multiplying the cost by the current ITC percentage. For example, if your solar panel system costs $20,000, your ITC would be $6,000 (30% of $20,000). New England Solar Programs can provide guidance on how to calculate your ITC.

Claim Your ITC: To claim your ITC, you’ll need to file IRS Form 5695 with your federal taxes. The ITC can be claimed on both residential and commercial solar installations.

Take Advantage of State and Local Solar Incentives: In addition to the federal ITC, many states and local governments in New England offer their own solar incentives and rebates. By taking advantage of these programs, homeowners and businesses can significantly reduce the cost of their solar installation and increase their overall savings.

The solar Investment Tax Credit is a valuable incentive for homeowners and businesses in New England to make the switch to solar power. By working with New England Solar Programs, you can calculate your ITC and take advantage of other solar incentives and rebates to make the switch to solar more affordable. With the help of New England Solar Programs, you can enjoy the many benefits of clean, renewable solar power and reduce your carbon footprint.